New US reports reveal impact of remote work on office real estate

The American office sector faces a major challenge to reimagine its future in the face of hybrid work patterns according to data-led studies by the US Census Bureau and Cushman & Wakefield

The extent to which the rise of remote and hybrid working has affected American business districts, workspace demand and daytime city populations has been revealed by two new US studies, which lay bare the stark implications for office real estate.

A review of US Census Bureau data by analyst Earlene K.P. Dowell shows how the daytime population of traditional job hubs across America slumped in 2020 as the Covid-19 pandemic pushed more people to work from home, and how the ramifications of this massive ‘spatial shift’ are still unravelling today.

Meanwhile, a new report from the US branch of property services giant Cushman & Wakefield predicts there will be an excess of 330 million square feet of vacant office space in the American real-estate market by the end of this decade and calls for office assets to be repositioned or repurposed to meet the hybrid challenge head on.

Traditional workday in past

The US Census data analysis by Earlene K.P. Dowell used commuting data coupled with statistics from other federal government agencies and external organisations to convey a message that the ‘traditional 9-to-5 workday might become a thing of the past’.

The shift to working from home among large sections of the workforce significantly affected commuting and consumer spending in restaurants and retail outlets as well as demand for commercial real estate. Workers were ‘no longer stopping at local coffee shops for their daily lattes, dropping off their dry cleaning, or gathering at their favourite lunch spots’. The percentage of US workers commuting by public transportation fell to its lowest ever level in 2021 – just 2.5 per cent (it was 5 per cent in 2019).

Industries most affected by this shift were information and professional, scientific and technical services, while remote working was less common in sectors such as retail, manufacturing, and accommodations and food services.

According to Chris Worley, a consultant with Fourth Economy Consulting who provided a commentary on the US Census data findings, some of these trends may now be embedded as the norm.

‘The daytime population moved from urban job centres to more suburban and rural areas…’

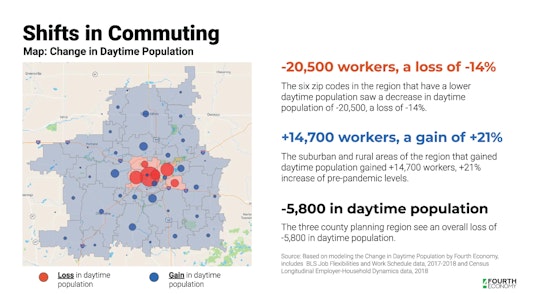

Worley’s interrogation of the data showed how the daytime population in the US moved from traditional urban job centres to more suburban and rural areas. A typical example is the Lansing, Michigan region, which, he pointed out, is based primarily on education, health, manufacturing, and the emerging finance and tech sectors. Lansing’s daytime population fell by 5,800, he said, because of the drop in commuters to job hubs

Imagery: Courtesy of Fourth Economy, via United States Census Bureau

Far-reaching implications

The central conclusion of the US Census data analysis is that a shift to remote work has ‘far-reaching implications across a variety of areas’. Quite how far-reaching the implications are for office real-estate is outlined in Cushman & Wakefield’s new report, entitled ‘‘Obsolescence Equals Opportunity’.

This says that ‘the US office sector is facing an unprecedented imbalance in supply and demand—one that will result in an excess of 330 million square feet of vacant space by the end of the decade brought on by the impacts of the hybrid work environment’.

The paper sets out the key challenge facing office professionals. After the pandemic, workspace occupiers increasingly want higher sustainability standards and a better in-person experience for employees. But 70 per cent of America’s office stock was build prior to 1990 and is outdated by today’s more rigorous criteria.

‘70 per cent of America’s office stock was build prior to 1990 and is outdated by today’s criteria…’

Navigating the future will be tough in a climate where ‘the relationship between job growth and office demand has fractured’ and there is so much mediocre, low quality office stock around. But the report’s authors, Abby Corbett, Kevin Thorpe and David Smith, see an upside. Their message is that commercial obsolescence presents new opportunities. Just as retail property didn’t die with the e-commerce boom, so ‘the office sector is not in danger of demise’.

What is needed is a recognition of the need for structural change and ‘reimagination strategies’ for renewal and growth. The report goes onto outline two key directions: repositioning office assets (including improving amenities, building out sustainability offerings and creating a sense of place); and repurposing office assets (including conversions to mixed use or medical and life science facilities).

Reading across both studies, the US office sector is now facing a critical chapter of adaptation and evolution that will require new skills and new investment, but it has a pathway to a brighter future provided it has the courage and imagination to take it.

Access the analysis of US Census Bureau data here. Access the Cushman & Wakefield report, ‘Obsolescence Equals Opportunity: The Next Evolution of the Office and How Repositioning and Repurposing will Reshape the Future’, here.